The final post of the year. Happy New Year to all and look forward to building G3 in 2025.

Inspiration and perspiration.

Napoleon used to inspire his men before battle with heroic speeches often making references to the long arc of history to get to his men’s souls. But that’s not adequate - Napoleon read voraciously and it was his reading of a strategy book in 1772 that gave him the ability to spot opportunities in the heat of battle 30 years later. To win, you need both inspiration and perspiration. No other way around it.

.

Churchill “people will forgive you for your mistakes in your 20s and it is only when you reach your 30s when people start to judge you based on your achievements”

So what’s lesson here? Start early. Make those embarrassing mistakes early while it’s still cheap to do so. To be fair in my case it felt rather unsettling seeing your peers advance through the ranks while you get stuck in a rut doing your own thing. But now that I look back, it was worthwhile crawling through the mud that early. Would do it all over again.

.

One shall be bestowed with great wealth upon successfully resolving an open-ended question where relatively few agree with the majority still in the opposite camp.

This is a conjecture purely from observation. But I genuinely believe this to be true. When nobody agrees, then it’s either non-valid or rather too early. The key then is how would one appropriately define the statement of ‘relatively few agree’. Are there frameworks out there that are useful for picking up the signals?

.

False precision

The idea of burying oneself in endless fancy metrics and analysis whilst avoiding any truth-seeking endeavors.

.

Risk posture

Howard Marks in his Oct 2024 coined this term. I like it. Every investor should intuitively AND intellectually know his natural or baseline risk posture - the right mix between defense & offense. And also when to depart when Mr Market demands for such. He also imparts that high risk high return rubrik is misleading, it’s more accurate to say higher risk means wider return distribution / wider possible outcomes (positive and negative).

.

The latin phrase: ‘quis custodiet ipsos custodes’

Literal translation is who will watch over the watchmen? Humans generally do not hold themselves to the standard that they would otherwise apply to others.

.

Capitalism as a detective work rather than an optimization work

As Rory Sutherland likes to say, we have burdened ourselves with over-measurement and numerical optimization that we have forgotten that in order to create true value, experimentation and exploration of the initially unquantifiable is required.

.

Schumpeterian Rent

The temporary period between initial disruption and mainstream adoption/competition where a company makes huge revenues/profits relative to others due to being the only game in town. Finally found a term to describe NVIDIA’s recent performances.

.

Unfair to conflate customer value with cheapness of acquisition.

We have an unhealthy obsession with trying to only serve customers at the lowest transactional cost channel. This thinking leads to the narrow mindset of only serving demand rather than trying to serve and create demand. The reality is different people respond to different channels.

.

Live your life to discover the point where you meet people who found you the way you want to be found. Then offer service to those people to reach eternal peace.

.

SCIENCE

1 / The NNC2215 macrocycle (yes! Macrocycles!) has the ability to bind to insulin receptors as conjugates to turn on insulin sensitivity when bloodstream glucose is high AND when glucose is low also having the ability to shut ‘off’ the sensitivity of the receptors. What a miracle! I saw this firsthand with my grandma going through volatile swings from hypo to hyperglycemia and back again constantly for 3 weeks straight. It was painful to watch.

2 / In keeping with the topic of switches, researchers in Switzerland has found a way to either re-activate or de-activate CAR-T cells. The crazy part is the MoA is via oral drugs that are already approved. Currently going into clinic phase - let’s hope it works.

3 / A longform arguing why AI alone will not be sufficient to unlock the purported century of biology as improvements in the wetlab also need to happen. The inherent complexity of biology and speed of biological AND chemical processes are well-documented rate limiting factors for wetlab improvements. Lots to do for sure and the challenges can feel insurmountable, but let’s remember Francis & Crick only deciphered DNA structure not too long ago in the middle of last century and just look at how far we have gone 70 years later. Have faith.

4 / Switching gears a little bit to the positive side, here’s a video chronicling how AlphaFold2 has essentially solved the longstanding problem of protein folding after decades of very little progress. To quote one Mr Lenin: ‘there are decades where nothing happens; and there are weeks where decades happen’. Next up is trying to predict how proteins talk or interact to other molecules in the cellular system. LFG!

5 / the TRIGA fuel reactor is fascinating because it’s inherently meltdown proof. Let me explain. In the event of meltdown resulting in ever increasing temperature, the hydrogen atoms move faster thus disturbing the motion of the neutrons, which in turn reduces the surface area for the uranium to collide. Another fun fact? Metals feel colder when we touch them in cold weather not because metals have lower tenperature, but metals are simply efficient at taking away the heat from our skin.

6 / Often overlooked in discourse is the role of beta cells in the insulin sensitivity process relating to insulin receptors. In many diabetic patients, the overexpression of inceptors on the surface of the beta cells could lead to impaired insulin secretion and thus compromising insulin sensitivity leading to elevated blood sugar levels. Researchers have found that by knocking out the inceptors, we could improve insulin sensitivity but the question remains how to do it safely as the inceptor also plays a crucial role to remove excess insulin (homeostatis function).

BUSINESS & OTHERS

7 / Another banger from Brad. He defines his job as a student of the market & anthropology seeking to understand trends/anti-trends and value destroyers/creators to ultimately take advantage of the rare asymmetric opportunities when it arises.

8 / Rabois is a renowned world class operator for a reason (although I’m not always a fan of his other attributes, but who’s perfect anyway?). Few takeaways that I’d like to keep as mental models:

Founder/CEO to handpick hires as many as you can. Delay the delegation. If Tony Xu can handpick his first 1500 hires, you can do it.

One dimension is to think of “barrels vs ammunitions”. Ammunitions are your workhorse that stabilizes the org. Barrels are the ones that will create breakthroughs. Manage the ratio accordingly to your needs.

Another dimension is “value protector vs value creator”. You always need a very small minority of value protector who are typically experienced in their jobs (CFOs/finance, certain Ops role, compliance, legal especially) to make sure the biz doesn’t collapse i.e defensive in nature. The rest can be value creators. Take a bet on unproven folks.

Promote from within because external hires are risk. But people do plateau, so have a ratio of internal vs external. The steeper the company’s trajectory, the higher the need for external. Otherwise err to internal side.

Ask core team to list top 5 most impressive people and go recruit them. Rinse & repeat. That’s the way to build a company of A players.

It’s the company’s job to continuously make the mission & workplace challenging & rewarding in every angle. This is the best way to retain people.

Jack Dorsey likes to ask candidates “is there anything that would prevent you from accepting this offer?” upfront. Saves you a lot of hassle later on.

Develop taste. This means hang around the best folks in the specific role so you can benchmark what great looks like. Also do a lot of interviews to build taste muscle.

Failed to render LaTeX expression — no expression found

9 / I’m a big, big fan of Keyu Jin. Extremely eloquent economist. To understand China, one must know that it is politically centralized, but economically decentralized with implicit discrimination happening largely in the financing part of the value chain as most funds go through state-owned banks, which is subject to the central party’s whims. I also liked her joke “In america the parties change but policies stay the same, but China is the opposite where the party stays but policies shift dramatically”

10 / Rory argues for a network type of business, for it to work as intended it requires a large enough scale as an assumption. The problem is usually at the start because it takes time for people to form habit and correspondingly takes time for social copying to develop, which means that such endeavor may be devastatingly money losing in the initial days. This happens to Royal Mail in the 18th century, typical infrastructure projects like rails & roads. Therefore Rory’s argument is that for investors to assume such risk, we sort of need that business to be a monopoly (by concession or by technology or by brand) or at the very least very little competition at pre-scale. Competition in the early days not only dilute the network value but also confuses people thus slowing down adoption further.

11 / Elad, in a nonchalant way, arguing LLM is underhyped (lol wut?!). What was interesting is how he argued that the correct way to think of end products for LLM is by units of cognition or per unit of productive intelligence. And this wave (LLM transformers) is different from the other types of AI (RNN, GANs) which has been around for decades because the latter is essentially a supercharged statistical tool to sort & understand large datasets whereas the more recent transformer technology are really generators.

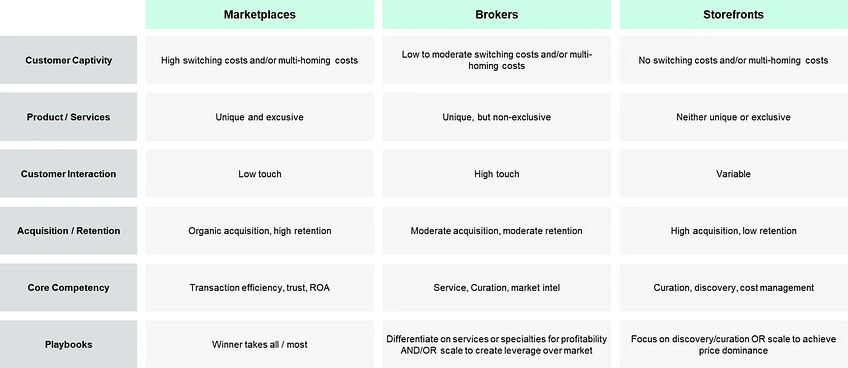

12 / Are you truly a marketplace? Or are you simply a broker? Or even just a storefront? This article argues the 2 key components for a true marketplace are:

(A) level of captivity (disincentives for supply to do multi-homing or multi-platform); and

(B) low touch (the more bespoke or involvement or even take 1P inventory you are, the worse your profitability potential will be)

Which is why App Store and eBay have better profit metrics than Amazon-esq platforms.

13 / Keith is absolutely right. Early stage investing is all about having great taste, which is why it’s hard to scale as very few people have it whereas later stage investing you can rely on data as the scaffolding to enact/maintain standards.

Thanks for the collection of wisdoms bro! Happy new year!!